Undervalued list

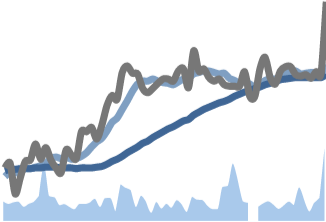

These companies are in the lower part of a rising trend and there has been a recently formed bottom-line pivot. The trend is a prime technical indicator and follows these catch phrases: "Let the trend be your friend" or "Don't drop out of a rising trend". Many people use this as a part of their trading strategy.

References to any specific securities and "candidate" do not constitute an offer to buy or sell securities.

UNLOCK

#1

UNLOCK

#5

#7

2.20

$18.05 -0.660%

#12

#13

1.98

$23.04 0.217%

#14

1.90

37,986.40 points 0.559%

#16

#18

#20

#25

2.61

$67.58 1.47%

#### - Click To Unlock

Exchange: NASDAQ Instrument: Stock