NYSE:BNO

USCommodity Brent Oil Fund LP ETF News

$31.02

+0.140 (+0.453%)

At Close: May 16, 2024

Rupee falls further against US dollar, nearing all-time low

12:00pm, Thursday, 03'rd Mar 2022 Business Recorder

A spectacular surge in oil prices took a toll on Pakistan''s currency as the rupee fell further against the US dollar on Thursday, inching ever so close to its all-time low after a 0.12% fall in the inter-bank market. As per the State Bank of Pakistan (SBP), the rupee closed at 177.83 after a day-on-day depreciation of 21 paisas or 0.12%. Its all-time low against the US dollar was recorded in December last year, when it closed at 178.24. The decline comes as oil prices extended their rally on Thursday, as Brent charged towards $120 a barrel , its highest in almost a decade amid US sanctions targeting Russian refineries, disruptions to shipping and a fall in US crude stocks to multi-year lows. Brent crude futures rose as high as $119.84 a barrel, the highest since May 2012. US West Texas Intermediate crude hit a high of $116.57, the loftiest since September 2008, and was at $116.41 a barrel, up $5.81, or 5.3%. Against USD: Rising oil prices add to rupee''s woes Meanwhile, Pakistan’s trade deficit continued to march upwards, widening by 22.1% on a year-on-year basis, jumping from $2.533 billion in February 2021 to $3.095 billion in February 2022, revealed the Pakistan Bureau of Statistics (PBS) data.

Brent oil nears $120 before cooling as traders shun Russia crude

11:46am, Thursday, 03'rd Mar 2022 Livemint

The global benchmark of Brent oil was trading near $115, after earlier adding as much as 6.1%. WTI touched its highest since 2008. Buyers are continuing to avoid Russian crude as they try and navigate financial sanctions, and traders are betting prices will keep rising

Fuel prices poised to flare up as oil hits 8-year high of $113

11:09am, Thursday, 03'rd Mar 2022 Economic Times India Energy

India’s crude cost also shot up $2 since February 24 to $102/barrel as Brent makes up 25% of the barrels bought by domestic refiners, making a fuel price shock inevitable after the last phase of polling in UP ends on March 7.

Oil hits 14-year peak, with Brent approaching $120 for first time since 2012

10:51am, Thursday, 03'rd Mar 2022 Economies

Oil prices rose on Thursday for the fourth straight session, with US crude hitting 14-year highs, …

Euro falls to lowest since 2016 vs sterling, Aussie dollar shines

10:28am, Thursday, 03'rd Mar 2022 Economic Times India

With Brent crude hitting a nine-year high above $119 per barrel, a dash for resources also gave commodity-linked currencies a lift, with Australia''s dollar climbing to its highest since November.

Brent Crude Oil Trades Near $120 Per Barrel on Thursday

10:17am, Thursday, 03'rd Mar 2022 Investors King

Global uncertainty amid flying rockets in Ukraine bolstered the price of Brent crude oil to $119.78 per barrel in the early hours of Thursday before paring gains to $118.72 as at 9:26 am Nigerian time.

Ukraine crisis sends oil prices surging to 10-year high

09:38am, Thursday, 03'rd Mar 2022 Evening Standard

Brent crude jumped close to 120 US dollars a barrel at one stage, marking the highest level since March 2012.

LIC IPO may be pushed to FY23 amid volatility

12:36am, Thursday, 03'rd Mar 2022 Economic Times India

New Delhi: The government will continue to hold roadshows and market the Life Insurance Corporation of India (LIC) public issue, but the offer may be pushed to next fiscal because of market volatility due to the Russia-Ukraine conflict, said officials with knowledge of the matter.The country''s biggest life insurer had filed the draft offer document for a 5% stake sale by the government on February 13. The initial public offer (IPO), expected to be the country''s biggest ever, was initially planned for this month."The process for it is already on and we are prepared to go ahead but when a war of this magnitude is happening, a review is certainly required," a top government official said, referring to the Ukrainian crisis and the upheaval it has caused in global financial markets. The issue pricing is yet to be decided, with some estimates pegging the offer size at about ₹63,000 crore. There is concern that such a big sale may be difficult in the current volatile market. Brent crude prices crossed $110 a barrel on Wednesday, Sensex fell 1.38%, bond yields rose, and the rupee weakened further against the dollar.89957886 Sensex down 10% from mid-Jan Peak The Sensex is down nearly 10% from its mid-January peak of over 61,000 as foreign portfolio investors have flooded the exits.Another official aware of deliberations said that the government will continue to hold roadshows and engage with potential anchor investors before taking a final decision on the timing of the IPO.

Ukraine war latest: Democrats urge US refineries to stop buying Russian oil

11:39pm, Wednesday, 02'nd Mar 2022 Newslanes

Oil pushed further above the $100 threshold and Asian shares sold off on Wednesday after Russia intensified its attacks on Ukraine’s biggest cities and adopted more aggressive tactics. Brent crude, the international benchmark, rose as much as 4.4 per cent to a seven-year high of $109.59 a barrel in early Asian trading, while US marker […] Ukraine war latest: Democrats urge US refineries to stop buying Russian oil

Commodity ETFs Rally Continues Amid Russia-Ukraine Conflict

10:51pm, Wednesday, 02'nd Mar 2022 Zacks Investment Research

Russia and Ukraine hold important positions as exporters in the global commodities market. Thus, the escalation in tensions has sparked a rally in a broad range of commodities.

Ukraine Invasion Scrambles Hedge Funds'' Outlook For Oil: Kemp

10:40pm, Wednesday, 02'nd Mar 2022 Zero Hedge

Ukraine Invasion Scrambles Hedge Funds'' Outlook For Oil: Kemp By John Kemp, Senior Market Analyst at Reuters Prior to Russia’s invasion of Ukraine, investors were reducing their bullish position in crude oil and refined products, which likely explains the extreme volatility once the military operation started. Hedge funds and other money managers sold the equivalent of 14 million barrels in the six most important petroleum-related futures and options contracts in the week to Feb. 22, according to regulatory data. Portfolio managers have been net sellers in four of the five most recent weeks… ... reducing their combined position to 714 million barrels from a recent peak of 761 million on Jan. 18. Before the invasion, the hedge fund community was still bullish about the outlook for prices, with the combined position in the 63rd percentile for all weeks since 2013. But funds were a little less bullish than they had been in the middle of January, when the combined position was in the 70th percentile.

There’s an oil market crisis even without sanctions on Russian exports

10:01pm, Wednesday, 02'nd Mar 2022 Marketplace

Brent crude rose above $113 a barrel Wednesday — the highest level in eight years.

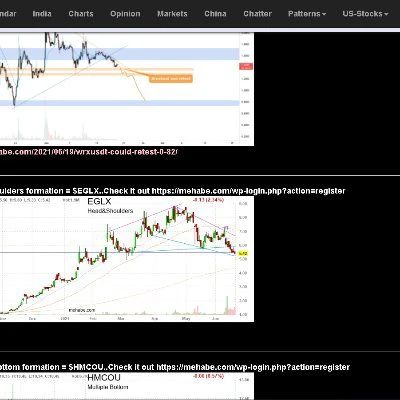

Brent #oil crude briefly hit $115/bbl, highest level since 2014, as Russia-Ukraine war fuels panic b

09:00pm, Wednesday, 02'nd Mar 2022 Mehabe

Brent #oil crude briefly hit $115/bbl, highest level since 2014, as Russia-Ukraine war fuels panic buying & OPEC+ sticks to plan for small April output rise despite surging prices. h/t Holger Zschaepitz Our Twitter for Quick Updates: Twitter Follow Us

Oil marches higher with sights on $114 a barrel

07:10pm, Wednesday, 02'nd Mar 2022 Al Jazeera

The market''s surge has been dramatic, with global benchmark Brent crude gaining 11 percent this week alone.

Russia-Ukraine crisis: Brent crude tops $121 a barrel, wheat at 24-yr high

07:07pm, Wednesday, 02'nd Mar 2022 Business Standard

In India, MCX crude futures for March 21 delivery hit an all-time high of $8,274 a barrel.