In the fast-paced world of artificial intelligence, Advanced Micro Devices (AMD) is emerging as a strong competitor, following closely behind the leader Nvidia (NVDA). AMD's entry into the AI chip market, with its cost-effective solutions and strategic partnerships with major tech giants, positions it to capitalize on the AI revolution's expansive growth. With innovations like the MI300 processor challenging NVDA's dominance and a focus on AI in mobile and computing devices, AMD is set to become a pivotal force in shaping the future of AI technology.

Technical Analysis of Advanced Micro Devices, Inc. (AMD)

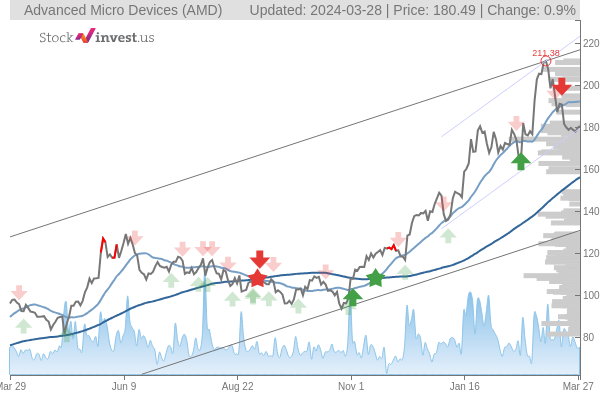

Advanced Micro Devices (AMD) closed the trading day on March 28, 2024, at $180.49, marking a modest increase of $0.90 (0.50%) from the previous close. The trading range for the day was between $178.3 and $183.4, indicating some volatility, but the closing price remained close to the 50-day moving average of $180.74.

A significant note is the Relative Strength Index (RSI) of 24, hinting at potential oversold conditions, which could suggest an upcoming reversal if investors start seeing it as a buying opportunity.

The Moving Average Convergence Divergence (MACD) stands at 3.790413, reinforcing the momentum observed in AMD's recent price movement. The disparity between the 50-day and the 200-day moving averages ($180.74 and $131.89, respectively) highlights the stock's bullish trend over the medium term.

However, with the stock currently trading near its support level of $174.23 and away from the resistance at $192.53, the technical indicators suggest that AMD may face challenges in breaking out in the immediate future without significant driving news or market changes.

Fundamental Analysis and Market Sentiment

AMD's market cap stands impressively at approximately $291.63 billion, underscoring the company's substantial size and influence within the semiconductor industry. Despite a high Price-to-Earnings (PE) ratio of 340.55, reflecting investor confidence in its growth potential, a deeper look into market sentiment and recent news highlights optimism surrounding AMD's future. Analyst consensus rates AMD as a "Buy," with a target consensus price of $149.97, which, despite being below the current trading price, seems to factor in conservative growth expectations.

Recent news focuses on AMD's strides in AI, specifically with its MI300 chips. While not as advanced as Nvidia's offerings, AMD's products are finding their place among small enterprises and governmental bodies. The news suggests a strong growth trajectory in the AI sector, supported by analysts identifying AMD as one of the "7 Stocks Primed for Sustained Growth and Prosperity."

AMD's inclusion in discussions about the "Magnificent Seven" stocks to watch in 2024 further solidifies its position as a key player in the rapidly evolving semiconductor industry, especially in the AI and GPU markets.

AMD Intrinsic Value

The discounted cash flow (DCF) calculation of $66.78 for AMD indicates a potential undervaluation based on future cash flow expectations. However, it's important to contextualize this with the company's growth prospects in AI and semiconductors, sectors prone to rapid innovation and intense competition.

Given the company's PE ratio and optimistic analyst outlooks balanced by its current high trading price, AMD appears as a potentially lucrative but risky long-term investment. Success in leveraging its technological advancements and expanding market share in AI could significantly enhance its intrinsic value over time.

Overall Evaluation of AMD Stock

Considering the technical indicators, fundamental analysis, and AMD's strategic positioning within the AI and semiconductor markets:

| Indicator | Value | Remarks |

|---|---|---|

| AMD Closing Price on March 28, 2024 | $180.49 | Modest increase of $0.90 (0.50%) from the previous close |

| Trading Range on March 28, 2024 | $178.3 - $183.4 | Indicates some volatility |

| 50-day Moving Average | $180.74 | |

| Relative Strength Index (RSI) | 24 | Hinting at potential oversold conditions |

| Moving Average Convergence Divergence (MACD) | 3.790413 | Reinforces recent price momentum |

| 50-day vs 200-day Moving Averages | $180.74 vs $131.89 | Highlights bullish trend over the medium term |

| Support Level | $174.23 | |

| Resistance Level | $192.53 | |

| Market Cap | Approx. $291.63 billion | |

| Price-to-Earnings (PE) Ratio | 340.55 | Reflects high investor confidence |

| Analyst Target Consensus Price | $149.97 | Below current trading price, conservative growth expectations |

| Discounted Cash Flow (DCF) | $66.78 | Indicates potential undervaluation |

AMD can be considered a Hold for current investors and a cautious Buy for potential investors with an appetite for risk and a long-term investment horizon.

The recommendation reflects AMD's strong growth prospects and its current market challenges. Investors should watch for fluctuations around support and resistance levels for entry points, keeping an eye on industry developments and AMD's execution of its AI strategy. Despite short-term uncertainties, AMD's long-term prospects remain promising, particularly for investors focused on growth sectors like semiconductors and AI technologies.

AMD

AMD