NYSEARCA:ARKK

ARK ETF News

$45.45

+0.490 (+1.09%)

At Close: May 17, 2024

Cathie Woods ARKG and ARKK rally alongside the surging Nasdaq

04:28pm, Tuesday, 07'th Dec 2021 Seeking AlphaStocks Soar After Gartman Says "A Bear Market Is Required" And "Stocks Are Headed Lower"

08:16pm, Monday, 06'th Dec 2021 Zero Hedge

Stocks Soar After Gartman Says "A Bear Market Is Required" And "Stocks Are Headed Lower" To those who listened to Goldman trader Scott Rubner who in a note last night said " We Have Seen The Lows For The Year ", and bought the latest dip, congratulations. To those who are still not convinced, and believe that the slide has more to go, we present what may be the most irrefutable exhibit that the massively oversold market has nowhere to go but up: speaking to Bloomberg radio this morning, Dennis Gartman, who is no longer known as the author of the Gartman letter (since that was halted several years ago and is now being only sent out to "friends and family" for obvious reasons), but is instead the University of Akron Endowment Chairman, and who said that A bear market is required at this point." We had an expansion for a long period of time and I think over the course of next year, he or she who loses the least amount of money will be the winner. That he or she probably will excludes those who listen to Dennis, because if just going by this example, stocks have exploded since Gartman''s latest "forecast." For those who are worried they missed the Gartman dip, fear not: in the wide-ranging interview about stock market volatility and over-valued equities, Wall Street''s favorite contrarian indicator (at least until Ray Dalio''s "cash is trash" prediction became the surest indicator of an imminent market crash) predicted that prices should go lower within the next year and the 10-year Treasury yield will rise to 2-3% over the next several years. The Fed clearly will be tightening monetary policy rather than being as expansionary as it has been, and stock prices are probably headed -- the best that one can say is, Get the trend right and I think that the trend is now to the down, not the upside. And there goes your bearish case.

Kestra Private Wealth Services LLC Buys 13,324 Shares of ARK Innovation ETF (NYSEARCA:ARKK)

03:42pm, Monday, 06'th Dec 2021 Transcript Daily

Kestra Private Wealth Services LLC raised its stake in shares of ARK Innovation ETF (NYSEARCA:ARKK) by 42.0% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 45,074 shares of the companys stock after purchasing an additional 13,324 shares during the period. Kestra []

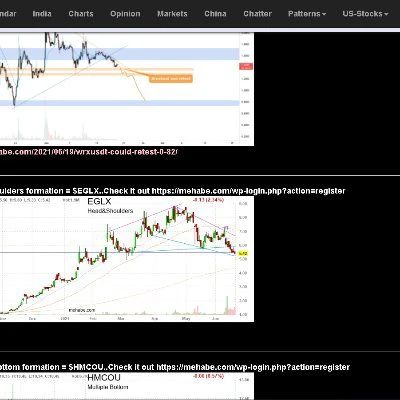

Market Crash or a Head-Fake? This is the all-important question as hyped stocks (Ark Innovation, IPO

03:30pm, Monday, 06'th Dec 2021 Mehabe

Market Crash or a Head-Fake? This is the all-important question as hyped stocks (Ark Innovation, IPO Index, #Bitcoin) continue to fall. h/t Holger Zschaepitz Our Twitter for Quick Updates: Twitter Follow Us

Joel Isaacson & Co. LLC Decreases Stake in ARK Innovation ETF (NYSEARCA:ARKK)

04:16pm, Sunday, 05'th Dec 2021 Dakota Financial News

Joel Isaacson & Co. LLC reduced its holdings in ARK Innovation ETF (NYSEARCA:ARKK) by 2.8% during the 3rd quarter, HoldingsChannel.com reports. The institutional investor owned 16,286 shares of the companys stock after selling 467 shares during the period. Joel Isaacson & Co. LLCs holdings in ARK Innovation ETF were worth $1,800,000 at the end of []

ARK Innovation ETF (NYSEARCA:ARKK) Shares Sold by Arkadios Wealth Advisors

11:20am, Sunday, 05'th Dec 2021 Transcript Daily

Arkadios Wealth Advisors reduced its position in shares of ARK Innovation ETF (NYSEARCA:ARKK) by 55.0% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 5,571 shares of the companys stock after selling 6,817 shares during the period. Arkadios Wealth []

ARK Innovation ETF (NYSEARCA:ARKK) Shares Bought by Safeguard Investment Advisory Group LLC

04:24pm, Saturday, 04'th Dec 2021 Dakota Financial News

Safeguard Investment Advisory Group LLC increased its stake in ARK Innovation ETF (NYSEARCA:ARKK) by 17.3% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 55,625 shares of the companys stock after purchasing an additional 8,197 shares during the period. ARK Innovation ETF accounts []

All of the stocks in Cathie Woods Ark Innovation fund are in a bear market except 2. Trimble and Tesla.

03:09pm, Saturday, 04'th Dec 2021 Investment Watch Blog

www.cnbc.com/2021/12/03/all-of-the-stocks-in-cathie-woods-ark-innovation-fund-are-in-a-bear-market-except-2.html Its been a dismal week for Cathie Woods flagship fund, Ark Innovation, thats left nearly all of her holdings in bear market. Woods main exchange-traded fund, which trades under

ARK Innovation ETF (NYSEARCA:ARKK) Shares Acquired by Johnson Bixby & Associates LLC

03:02pm, Saturday, 04'th Dec 2021 Dakota Financial News

Johnson Bixby & Associates LLC increased its position in ARK Innovation ETF (NYSEARCA:ARKK) by 10.5% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 3,153 shares of the companys stock after buying an additional 300 shares during the period. []

ARK Innovation in 2021: From Market Leader to Laggard

09:11pm, Friday, 03'rd Dec 2021 GuruFocus

The ETF was flying high on sweet returns in 2020, but 2021 has left investors with a bitter taste Check out Catherine Wood Stock Picks » Download GuruFolio Report of Catherine Wood (Updated on 12/02/2021) Related Stocks: ARKK ,

Fridays ETF Movers: QVML, ARKK

08:23pm, Friday, 03'rd Dec 2021 FXNews24

In trading on Friday, the Invesco S&P 500 QVM Multi-factor ETF is outperforming other ETFs, up about 1.1% on the day. Components of that ETF showing particular strength include shares of The Cooper Companies, up about 2.9% and shares of Nucor, up about 2.5% on the day. And underperforming other ETFs today is the ARK [] The post Fridays ETF Movers: QVML, ARKK appeared first on UK Stocks, Forex, Commodities, Crypto, Live Market News- Daily Forex News .

All of the stocks in Cathie Wood’s Ark Innovation fund are in a bear market except 2

08:08pm, Friday, 03'rd Dec 2021 Bitcoin Ethereum News

The post All of the stocks in Cathie Wood’s Ark Innovation fund are in a bear market except 2 appeared on BitcoinEthereumNews.com . Catherine Wood, chief executive officer of ARK Investment Management LLC, speaks during the Milken Institute Global Conference in Beverly Hills, California, on Monday, Oct. 18, 2021. Kyle Grillot | Bloomberg…

Cathie Wood''s ETF Is Unraveling

08:03pm, Friday, 03'rd Dec 2021 Zero Hedge

Cathie Wood''s ETF Is Unraveling Cathie Wood''s ARKK is sinking. Her flagship ETF, the ARK Innovation Fund, which was already having a dismal year, lagging major indices about 35%, is plunging to end the week today. Heading into the close, it''s down about 6.3% and was down well below $100. On Friday, the damage got worse. Among Wood''s woes were her holdings in Docusign, which by mid-day was down an astonishing 41%. Additionally, Wood "bought the dip" by purchasing 2.1 million shares of Ginko Bioworks on Thursday, Bloomberg reported. On Friday, the stock fell by as much as 16%, at one point marking a 28% loss in just 5 days, amounting to $5 billion in value lost. Bloomberg noted that ARKK hit some ugly technical indicators on Friday, as well. The stock''s RSI plunged to 20 and saw a "trading range breakdown" according to technical analysis prepared by William Maloney, the voice of the U.S. equity squawk for Bloomberg. ETF expert Eric Balchunas put the performance in perspective on Friday.

Smith Anglin Financial LLC Has $10.64 Million Stock Holdings in ARK Innovation ETF (NYSEARCA:ARKK)

05:32pm, Friday, 03'rd Dec 2021 Dakota Financial News

Smith Anglin Financial LLC increased its stake in ARK Innovation ETF (NYSEARCA:ARKK) by 69.0% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 96,285 shares of the company’s stock after acquiring an additional 39,316 shares during the quarter. ARK Innovation ETF […]

Vigilare Wealth Management Makes New Investment in ARK Innovation ETF (NYSEARCA:ARKK)

04:50pm, Friday, 03'rd Dec 2021 Transcript Daily

Vigilare Wealth Management acquired a new position in ARK Innovation ETF (NYSEARCA:ARKK) in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm acquired 2,208 shares of the companys stock, valued at approximately $244,000. Several other hedge funds have also added to or reduced their stakes in []