Village Bank & Trust Financial Corp Stock Forecast

Weaker technical forecast for Village Bank & Trust Financial Corp as stock downgraded to Hold/Accumulate.

(Updated on Apr 25, 2024)

No changes to the price of Village Bank & Trust Financial Corp stock on the last trading day (Thursday, 25th Apr 2024). During the last trading day the stock fluctuated 0% from a day low at $42.35 to a day high of $42.35. The price has risen in 5 of the last 10 days and is up by 3.07% over the past 2 weeks.

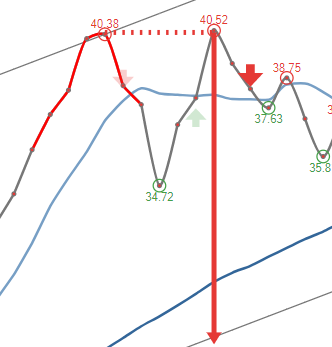

The stock lies the upper part of a falling trend in the short term, and this may normally pose a very good selling opportunity for the short-term trader as reaction back towards the lower part of the trend can be expected. A break up at the top trend line at $42.44 will firstly indicate a slower falling rate, but may be the first sign of a trend shift. Given the current short-term trend, the stock is expected to fall -2.33% during the next 3 months and, with a 90% probability hold a price between $38.75 and $41.45 at the end of this 3-month period. Do note, that if the stock price manages to stay at current levels or higher, our prediction target will start to change positively over the next few days as the conditions for the current predictions will be broken.

Ready to grow your portfolio? Here's your beginner's guide to opening a free brokerage account.

VBFC Signals & Forecast

The Village Bank & Trust Financial Corp stock holds buy signals from both short and long-term Moving Averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average. On corrections down, there will be some support from the lines at $41.85 and $41.42. A breakdown below any of these levels will issue sell signals. Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Some negative signals were issued as well, and these may have some influence on the near short-term development. A sell signal was issued from a pivot top point on Wednesday, April 24, 2024, and so far it has fallen 0%. Further fall is indicated until a new bottom pivot has been found. Volume fell on the last day without any changes to the price. This does not cause any direct divergence but may be an early warning and a possible "turning point". The very low volume increases the risk and reduces the other technical signals issued.

Support, Risk & Stop-loss for Village Bank & Trust Financial Corp stock

Village Bank & Trust Financial Corp finds support from accumulated volume at $41.12 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

In general the stock tends to have very controlled movements and therefore the general risk is considered very low. However, be aware of low or falling volume and make sure to keep an eye on the stock During the last day, the stock moved $0 between high and low, or 0%. For the last week the stock has had daily average volatility of 0.228%

The Village Bank & Trust Financial Corp stock is overbought on RSI14 and lies in the upper part of the trend. Normally this may pose a good selling opportunity for the short-term trader, but some stocks may go long and hard while being overbought. Regardless, the high RSI together with the trend position increases the risk and higher daily movements (volatility) should be expected. A correction down in the nearby future seems very likely and it is of great importance that the stock manages to break the trend before that occurs.

Our recommended stop-loss: $40.88 (-3.46%) (This stock has low daily movements and this gives low risk. The RSI14 is 77 and this increases the risk substantially. There is a sell signal from a pivot top found 1 day ago.)

Trading Expectations (VBFC) For The Upcoming Trading Day Of Friday 26th

For the upcoming trading day on Friday, 26th we expect Village Bank & Trust Financial Corp to open at $42.35, and during the day (based on 14 day Average True Range), to move between $42.05 and $42.65, which gives a possible trading interval of +/-$0.302 (+/-0.71%) up or down from last closing price. If Village Bank & Trust Financial Corp takes out the full calculated possible swing range there will be an estimated 1.43% move between the lowest and the highest trading price during the day.

Since the stock is closer to the resistance from accumulated volume at $42.50 (0.35%) than the support at $41.12 (2.90%), our systems don't find the trading risk/reward intra-day attractive and any bets should be held until the stock is closer to the support level.

Is Village Bank & Trust Financial Corp stock A Buy?

Village Bank & Trust Financial Corp holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development. Due to some small weaknesses in the technical picture we have downgraded our analysis conclusion for this stock since the last evaluation from a Buy to a Hold/Accumulate candidate.

Current score: 0.219 Hold/Accumulate Downgraded

Predicted Opening Price for Village Bank & Trust Financial Corp of Friday, April 26, 2024

| Fair opening price April 26, 2024 | Current price |

|---|---|

| $42.35 ( 0%) | $42.35 |

The predicted opening price is based on yesterday's movements between high, low, and closing price.

Trading levels for VBFC

Fibonacci Support & Resistance Levels

| Level | Price | |||

|---|---|---|---|---|

| Resistance | R3 | 42.35 | . | |

| R2 | 42.35 | . | ||

| R1 | 42.35 | . | ||

| Current price: | 42.35 | |||

| Support | S1 | 42.35 | . | |

| S2 | 42.35 | . | ||

| S3 | 42.35 | . |

Accumulated Volume Support & Resistance Levels

| Level | Price | |||

|---|---|---|---|---|

| Resistance | R3 | 43.18 | 1.95 % | |

| R2 | 42.61 | 0.614 % | ||

| R1 | 42.50 | 0.354 % | ||

| Current price | 42.35 | |||

| Support | S1 | 41.12 | -2.90% | |

| S2 | 40.98 | -3.23% | ||

| S3 | 40.30 | -4.84% |

VBFC Dividend Payout History

| # | Ex-Date | Pay Date | Amount | Yield | |

|---|---|---|---|---|---|

| 1 | Feb 27, 2024 | Mar 07, 2024 | Mar 15, 2024 | $0.180 | 0.432% |

| 2 | Nov 14, 2023 | Nov 22, 2023 | Dec 01, 2023 | $0.180 | 0.453% |

| 3 | Aug 28, 2023 | Sep 07, 2023 | Sep 15, 2023 | $0.160 | 0.361% |

| 4 | May 23, 2023 | Jun 02, 2023 | Jun 12, 2023 | $0.160 | 0.378% |

| 5 | Feb 28, 2023 | Mar 09, 2023 | Mar 17, 2023 | $0.160 | 0.294% |

FAQ

Click here for our free guide on how to buy Village Bank & Trust Financial Corp Stock.