Technically Undervalued (Potential Gainers)

(Updated 16 hours ago)

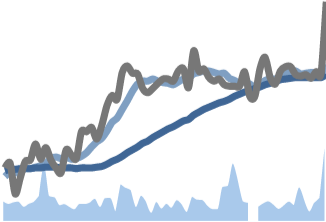

The companies in this list are in the lower part of a rising trend, and there has been a recently formed bottom pivot. In combination with the recent pivot bottom, there is a fair chance the stock(s) will perform positively and move higher within the trend.

#6

Very Low Risk

2.74

$54.99

0.0450%

#7

Very Low Risk

2.73

$76.34

0.144%

#8

Very Low Risk

2.67

$24.66

0.101%

#9

Very Low Risk

2.31

$79.63

-2.05%

#10

Very Low Risk

2.22

$53.77

0.0190%

#11

Very Low Risk

2.22

$78.17

0.0640%

#12

Very Low Risk

2.21

$49.03

0.0310%

#13

Very Low Risk

2.18

$24.58

0.122%

#14

Very Low Risk

2.16

$10.12

-0.394%

#15

Low Risk

2.11

$102.95

0.459%

#16

Low Risk

1.65

$59.04

-0.287%

#17

Very Low Risk

1.41

$23.14

0.0430%

#18

Very Low Risk

1.40

$18.81

0.0530%

#19

Very Low Risk

1.33

$29.96

-0.200%

#20

Very Low Risk

1.20

$1,250.20

0.337%

#21

Very Low Risk

1.08

$9.60

0.418%

#22

Medium Risk

1.01

$15.73

0.319%

#23

Very Low Risk

0.93

$10.85

0.463%

#24

#25

Enhance Your trading strategy with

Custom Stock Screeners. Build Yours now!

Trusted Broker

Start Your Journey With:

0% Commission Stock Trading

Follow Other Investors Strategy

Wide variety: Crypto, stocks, ETFs

Sign In

Sign In